lake county sales tax rate 2019

Lake Forest Park. 1717 035 065100 Lake Stevens.

An additional 100 fee will be charged to the buyers interested in obtaining a delinquent tax list.

. 4th Quarter effective October 1 2022 - December 31 2022 There were no sales and use tax county rate changes effective October 1 2022. If you attend the entire sale but are unable to purchase any taxes your deposit will be refunded. Code Local Rate State Rate Combined Sales Tax 1.

The entire combined rate is due on all taxable transactions in that tax jurisdiction. Salt Lake County UT Sales Tax Rate. The current total local sales tax rate in Lake County CO is 6900.

Amusement machine receipts - 4. Heres how Lake Countys maximum sales tax rate of 8375 compares to other counties around the United States. 3109 025 065 090 Lakewood.

UT Sales Tax Rate. All registered tax buyers and their appointed representatives at the tax sale must be 18 years of age or older at the time of registration. Groceries are exempt from the Lake County and Ohio state sales taxes.

3rd Quarter effective July 1 2022 - September 30 2022 There were no sales and use tax county rate changes effective July 1 2022. Sales and Use Tax and Discretionary Sales Surtax Rates. The December 2020 total local sales tax rate was also 0000.

Ad Find Out Sales Tax Rates For Free. The minimum combined 2022 sales tax rate for Lake County Illinois is 7. Fast Easy Tax Solutions.

2022 rate changes. 1 2019 Floridas sales tax rate on the total rent that commercial real estate owners charge and receive from tenants is 57 percent a decrease from 58 percent in 2018 and 60 percent in 2017. A county-wide sales tax rate of 15 is applicable to localities in Lake County in addition to the 575 Ohio sales tax.

Tax Rates Effective April 1 - June 30 2019. Location SalesUse Tax CountyCity Loc. The current total local sales tax rate in Salt Lake County UT is 7250.

Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 075. The December 2020 total local sales tax rate was also 7250. The Lake County Sales Tax is collected by the merchant on all qualifying sales made within Lake County.

Retail sales of new mobile homes - 3. If you have questions or concerns please call the Treasurers Office at 847-377-2323. Physical Address 18 N County Street Waukegan IL 60085.

For tax rates in other cities see Utah sales taxes by city and county. Hopefully this sheds a little light on the tax sale process. The Lake County sales tax rate is 0.

Lake County collects a. Lake County OR Sales Tax Rate The current total local sales tax rate in Lake County OR is 0000. While many counties do levy a countywide.

The Lake County Sales Tax is 15. Floridas general state sales tax rate is 6 with the following exceptions. 28 rows Lake County Has No County-Level Sales Tax.

You can print a 775 sales tax table here. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. 93 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

Posted on January 15 2019 by Karen Lake. Real property rentals subject to the reduced rate include commercial office space retail warehouses and certain. The longer time between the sale and redemption the higher the penalty is likely to be.

Sales tax and discretionary sales surtax are calculated on each taxable transaction. Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 15. This is the total of state and county sales tax rates.

State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes. The Minnesota sales tax of 6875 applies countywide. 2nd Quarter effective April 1 2022 - June 30 2022.

The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. While many counties do levy a countywide sales tax Lake County does not. The Lake County Ohio sales tax is 700 consisting of 575 Ohio state sales tax and 125 Lake County local sales taxesThe local sales tax consists of a 125 county sales tax.

The Illinois state sales tax rate is currently 625. Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest.

Florida Sales Tax Rates By City County 2022

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Sales Tax In Orange County Enjoy Oc

California Sales Tax Rates By City County 2022

Ohio Sales Tax Guide For Businesses

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

Property Tax City Of Decatur Il

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Louisiana Sales Tax Rates By City County 2022

Sales And Use Tax Rates Houston Org

Local Tax Information City Of Enid Oklahoma

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

West Virginia Tax Rates Rankings Wv State Taxes Tax Foundation

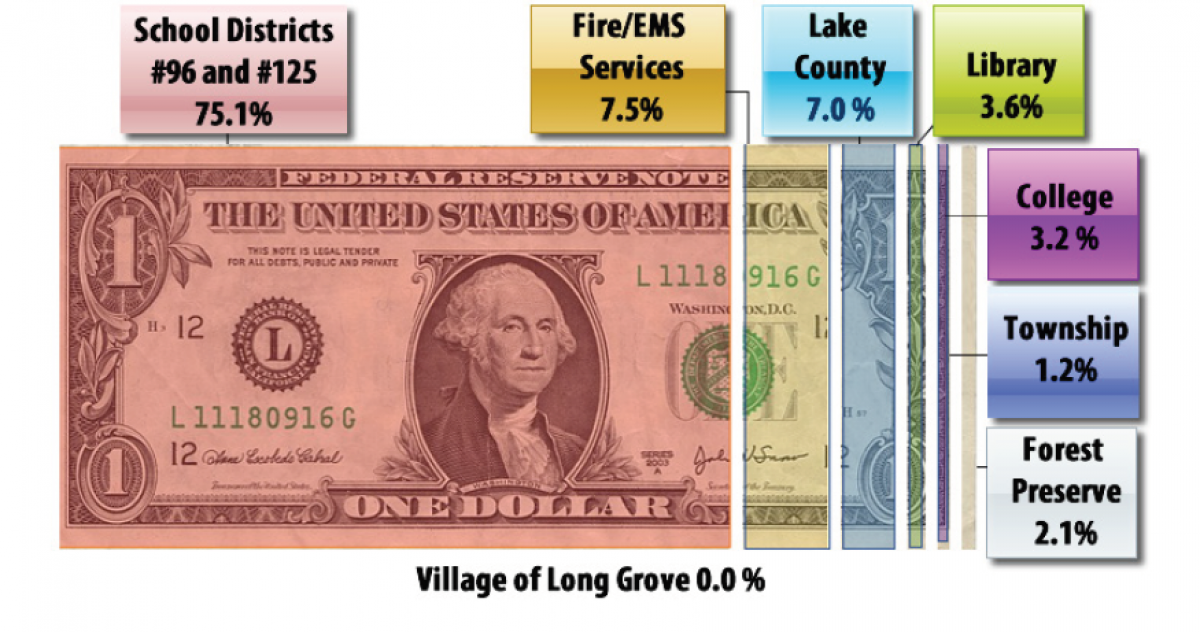

Taxes Fees Long Grove Illinois

Illinois Sales Use Tax Guide Avalara

West Virginia Tax Rates Rankings Wv State Taxes Tax Foundation